The Comprehensive Mortgage Process for Lenders: A Step-by-Step Guide

Understanding the Mortgage Process for Lenders

The mortgage process can be an intricate maze for lenders, requiring precise navigation through various stages to ensure satisfactory outcomes. As one of the critical avenues for home financing, understanding each element of the mortgage process for lenders is vital for success in this industry. This article delves into the various stages of the mortgage journey, elucidating the essential steps involved, best practices, and critical insights necessary for a streamlined and efficient lending experience. To gain more insights on this topic, you can refer to mortgage process for lenders, where detailed resources are available.

The Importance of Pre-Approval

Pre-approval serves as a foundational step in the mortgage process. It allows lenders to determine the maximum loan amount a borrower can qualify for based on their financial health. The significance of pre-approval cannot be overstated, as it provides both the lender and the borrower a clearer picture of the financial parameters involved in securing a loan.

This stage typically involves the lender reviewing essential documentation such as credit reports, income verification, and debt-to-income ratios. A solid pre-approval not only bolsters a borrower’s confidence but also enhances their position when negotiating with sellers. It clearly indicates to sellers that the borrower is serious and capable of following through with the purchase, thereby increasing the chance of the offer being accepted.

Gathering Essential Documents

The documentation phase is one of the most critical components of the mortgage process. Lenders require a variety of documents to mitigate risk and understand the borrower’s financial background. This stage usually includes:

- Proof of Income: Pay stubs, W-2 forms, and possibly tax returns.

- Credit History: A complete review of the borrower’s credit report to establish creditworthiness.

- Employment Verification: Contacting employers to confirm job status and salary.

- Assets and Liabilities: Bank statements and a list of current debts to assess the borrower’s financial stability.

By carefully gathering and reviewing this data, lenders can make informed decisions that ultimately enhance loan approval rates and generate more favorable loan terms.

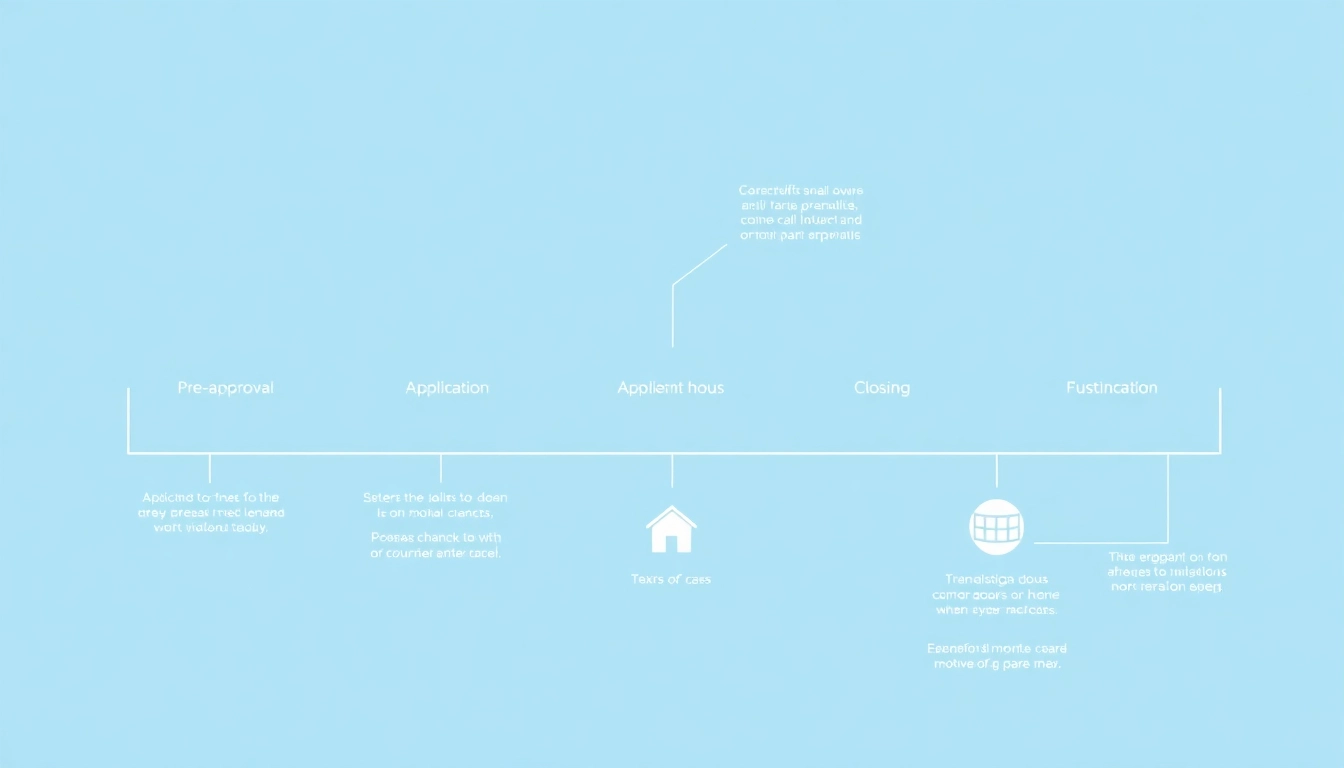

Key Stages in the Mortgage Process

Pre-Approval and Its Benefits

The process of pre-approval not only benefits borrowers, but it significantly aids lenders in managing risk. When a lender pre-approves a loan, they establish a relationship with the borrower based on trust and transparency, setting the stage for productive collaboration throughout the remaining stages of the mortgage process.

Moreover, a robust pre-approval allows lenders to evaluate market conditions and borrower qualifications efficiently. Understanding these elements positions lenders to optimize their offerings and services, ultimately increasing competitiveness in a saturated market.

Submitting Your Application

Once pre-approval has been established and documents have been compiled, borrowers can officially submit their mortgage application. This application will undergo intense scrutiny as lenders seek to ensure that all requirements are met and to assess overall risk accurately.

Advanced online platforms have simplified this process significantly, allowing borrowers to enter required information seamlessly. However, it remains crucial for lenders to encourage prospective clients to verify accuracy and completeness, as discrepancies can result in delays or denials of mortgage applications.

Loan Processing Explained

The loan processing stage is a critical period where the lender formally reviews applications, assesses risk, and prepares for underwriting. This phase can be intricate, as it involves:

- Verification: Ensuring that all provided documents are legitimate and accurate, reinforcing the borrower’s claims.

- Data Analysis: Conducting in-depth analyses of financial statements, credit reports, and other pertinent information to evaluate the borrower’s capability to repay.

- Communication: Prompt and continuous communication with the borrower to address any concerns or additional documentation needs.

Streamlining this process will reduce the stress for both lenders and borrowers, leading to improved client satisfaction and long-term relationships.

Underwriting and Its Role in Mortgage Approvals

What Underwriters Look For

Underwriting is a crucial buffer that determines whether a mortgage will be approved or denied. This phase is primarily about risk assessment. Underwriters evaluate various factors, including:

- Creditworthiness: Understanding the borrower’s credit history and score to predict future behavior.

- Income Stability: Reviewing income sources to ensure continuity and reliability.

- Property Appraisal: While lenders often require an appraisal, underwriters also confirm that the property meets certain value standards.

By systematically analyzing these elements, underwriters serve as guardians, simultaneously protecting the interests of both lenders and borrowers and facilitating sound loan decisions.

Common Challenges Faced During Underwriting

Despite the thoroughness of the underwriting process, certain challenges can often hinder the approval of mortgages, such as:

- Insufficient Documentation: Lack of or incomplete supporting documentation can derail an otherwise solid application.

- Low Credit Scores: Borrowers with poor credit histories may struggle to secure favorable terms or may be denied entirely.

- Appraisal Contingencies: Any discrepancies between the accepted offer and appraised value can result in negotiation hurdles or additional financing complexity.

Being proactive in addressing these potential issues during the application process can streamline outcomes and mitigate delays.

Timeline Expectations

Understanding the typical timeline for the mortgage underwriting process is essential for managing borrower expectations. Generally, from application to approval, the process can take anywhere from a few weeks to a month. The following are standard timelines to keep in mind:

- Initial Review: 1-3 days to complete a preliminary underwriting review of submitted documentation.

- Conditional Approval: 1-2 weeks to finalize evaluations and clear any stipulations based on conditions imposed during the initial review.

- Final Approval: 3 days minimum after the completion of all conditions to reach the “Cleared to Close” status.

Maintaining transparent communication with borrowers during this stage can greatly enhance trust and minimize frustration.

Closing the Deal: Final Steps in the Mortgage Process

Preparing for Closing Day

Closing day is arguably the most exciting stage of the mortgage process, marking the culmination of considerable effort and planning. Preparation for this day requires coordinated efforts among all parties involved, such as the lender, the borrower, and relevant real estate professionals. This process includes:

- Reviewing the Closing Disclosure: Borrowers must thoroughly review the Closing Disclosure, which outlines the final terms and closing costs associated with the mortgage.

- Securing Funds: Ensuring that sufficient funds are available, whether for down payments, closing costs, or other related expenses.

- Conducting a Final Walkthrough: Prior to closing, it’s advisable that buyers conduct a final walkthrough of the property to confirm its condition and adherence to agreed-upon repairs or adjustments.

A smooth closing day experience treats borrowers positively, as it represents the transition into home ownership and a new financial chapter. Lenders benefit from presenting a well-structured process, promoting satisfaction and trust.

Necessary Documentation

The vital documentation process leading up to closing requires attention to detail. Critical items the borrower needs to present include:

- Identification: A government-issued photo ID to verify identity on closing day.

- Proof of Homeowners Insurance: This ensures coverage for the property is active.

- Final Loan Documents: These documents outline the terms agreed upon concerning the mortgage.

Proper organization of these documents plays an influential role in a successful closing experience.

Final Walkthrough and Settling In

The final walkthrough serves as a last check for the borrower. This appointment allows them to confirm that all conditions have been met, and there have been no drastic changes since the last visit. Following a successful walkthrough, the buyer will sign the closing documents and finalize the transaction.

Once the deal closes, both lenders and borrowers should remain connected. Lenders can provide welcome packets or post-closing support to enhance the relationship and make borrowers feel valued.

Best Practices for a Smooth Mortgage Process

Tips for Effective Communication with Lenders

Effective communication establishes trust and transparency between lenders and borrowers. Utilize clear and concise language, and ensure timely responses to inquiries. Regular updates on the status of the application can alleviate borrower anxiety and foster confidence in the lender’s performance.

Moreover, employing an accessible platform for official communication ensures that all parties can refer back to prior discussions and commitments made during the process.

Avoiding Common Pitfalls

Even seasoned lenders can encounter obstacles during the mortgage process. Some common pitfalls include:

- Inconsistent Information: Ensure that all information provided by the borrower is accurate and consistent across documents.

- Inadequate Follow-Up: Regularly check in with applicants to gather any outstanding information promptly, preventing delays.

- Failure to Build Rapport: Establish a positive and trusting relationship with the borrower; it can make the entire process smoother.

By recognizing these challenges, lenders can proactively mitigate issues, leading to higher approval rates and satisfied clients.

Post-Closing Actions for Lenders

The conclusion of a mortgage transaction does not signal an end to the lender-borrower relationship. Engaging with clients post-closing can yield significant benefits. Consider actions such as:

- Follow-Up Calls: Check in with clients to address any ongoing needs or questions.

- Sending Educational Resources: Provide materials that soothe common inquiries, such as homeownership responsibilities or refinance options.

- Requesting Feedback: Solicit feedback on the loan process to improve future interactions and service quality.

Long-term engagement demonstrates a commitment to client satisfaction and establishes a solid foundation for potential future business opportunities.